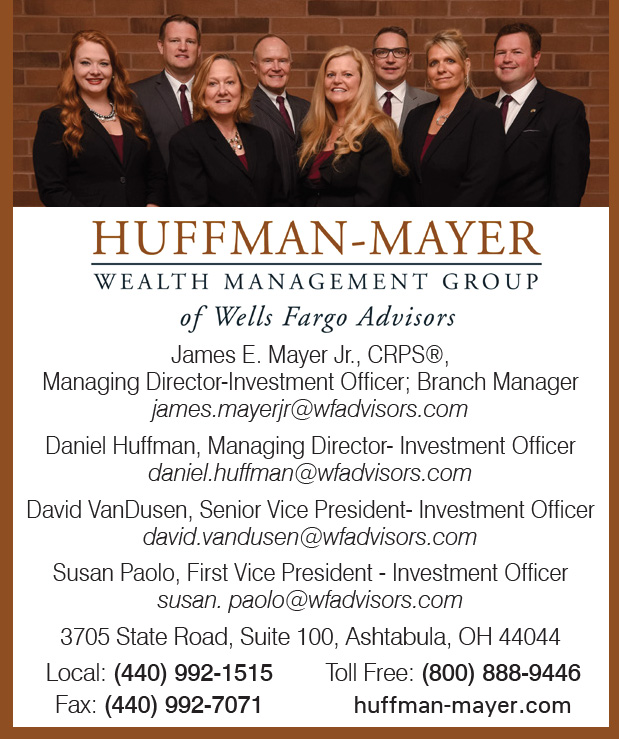

Susan Paolo, AAMS®, MBA, First Vice President – Investment officer

Susan Paolo, AAMS®, MBA, First Vice President – Investment officer

Before entering the financial services industry, Susan graduated from Hiram College, received her MBA from Lake Erie College, and worked as a Vice President for Bank of America, PNC Mortgage, and Wells Fargo Home Mortgage. Now, an Associate Vice President -Investment Officer with Wells Fargo Advisors, she takes pride in working for a firm that puts you first.

Five Star Wealth Manager Award for three consecutive years specializing in:

- Investment Strategies

- Tax-deferred Growth

- Business Owners

- Retirement Planning

- Retiement Income Planning

Making sure your wealth continues to work in support of the goals you have established.

Active member of the Ashtabula, Lake and Geauga communities for 25 years.

Planning for an Unexpected Early Retirement

Even with a solid retirement plan, life can involve unexpected and unanticipated changes.

About 46% of retirees left the workforce earlier than planned, according to the 2016 Retirement Confidence Survey released by the Employee Benefit Research Institute.*

Whatever the reason, corporate restructuring and downsizing, an earlier-than-expected retirement due to a health condition or the need to care for a loved one ― if you find yourself looking at an unplanned retirement, it’s crucial that you assess the situation and develop a strategic plan to enjoy the years ahead.

Think ahead.

#1 One way to get an extra layer of protection is to adjust your potential retirement date ― “target an earlier age,” advises Donna Peterson, Retirement Income Strategist for Wells Fargo Advisors.

For example, if your plan is to work until the age of 65, modify your savings strategy to fit the goal of retiring at age 55. If things go well and you end up working until 65, you have extra income to provide for some luxuries in retirement or pass on to family.

#2 Stay ahead of possible employment changes. Evaluate your current skills and think about pursuing education opportunities to update or realign your résumé. You may even opt to switch to a different field or industry if your current line of work comes to an end. While a later-in-life career change may seem daunting, it presents a great opportunity to pursue personal interests and passions that you never had time for in the past.

#3 Medical conditions can increase the odds of an early retirement. Look at the alternatives. If your current employer provides health coverage, you’ll need to replace this benefit after retiring. Perhaps you have a spouse who works and receives health insurance for the family — check the plan to determine if you can switch to your spouse’s health plan. Consider adding long-term disability coverage to provide income if you are injured and unable to continue working.

Adjust as needed.

If retirement comes as an unforeseen surprise, and you haven’t had the chance to create a “Plan B,” meet with your financial professionals to evaluate the impact.

“Consider your priorities,” suggests Peterson. To reduce expenses, look at what’s important and what could be given up. It may be a smart time to sell a large home. If you have two cars, it might be prudent to keep just one of them. Additional modifications, such as reducing gifts, simplifying your retirement lifestyle, and using “flexible retirement spending,” where you adjust your spending based on how your investments are performing.

Adjust as needed and make the most of your savings.

Create opportunities.

For an employment-forced early retirement, finding another position may be a key way to bring in income and avoid drawing from your portfolio ― allowing your investments to continue to grow.

If you retire early to take care of a loved one. You may still be able to take on a part-time job or one with a flexible schedule that accommodates your other responsibilities. You might also sell certain assets that are no longer needed.

After creating a contingency strategy, it’s possible that everything could still follow your original plan. If you end up working longer and saving more, you’ll be better equipped to meet your financial goals, enjoy life, and handle any unforeseen events or changes.

*https://www.ebri.org/publications/ib/index.cfm?fa=ibDisp&content_id=3328

This article was written by/for Wells Fargo Advisors and provided courtesy of Susan Paolo, MBA, AAMS® in Ashtabula Office at 440-992-1515.