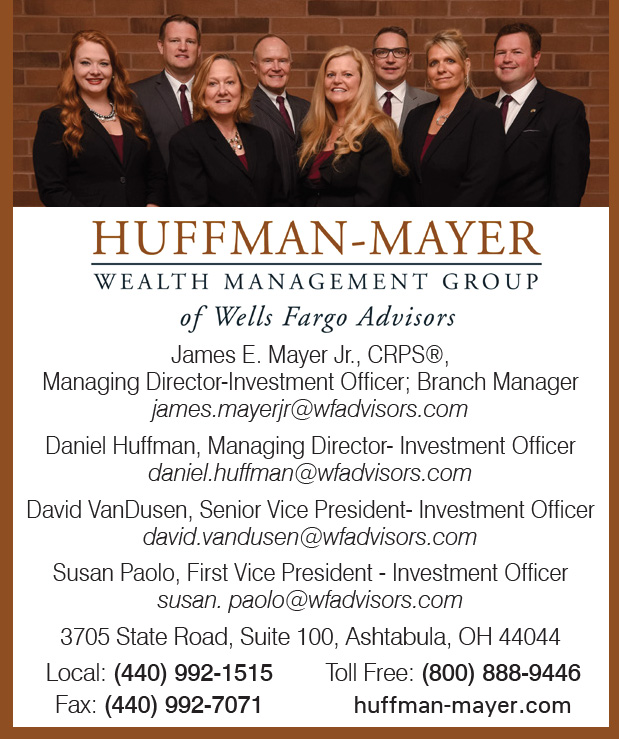

Susan Paolo, AAMS®, MBA, First Vice President – Investment officer

Susan Paolo, AAMS®, MBA, First Vice President – Investment officer

Before entering the financial services industry, Susan graduated from Hiram College, received her MBA from Lake Erie College, and worked as a Vice President for Bank of America, PNC Mortgage, and Wells Fargo Home Mortgage. Now, an Associate Vice President -Investment Officer with Wells Fargo Advisors, she takes pride in working for a firm that puts you first.

Five Star Wealth Manager Award for three consecutive years specializing in:

- Investment Strategies

- Tax-deferred Growth

- Business Owners

- Retirement Planning

- Retiement Income Planning

Only you can decide if claiming Social Security at age 62 or waiting to claim later makes more sense. Lifestyle and philanthropic intentions, marital and employment status, and gender are all factors.

When do you claim?

If you’re in a position to think through your Social Security claiming schedule, do it. It could mean thousands or tens of thousands to your annual retirement income.

Here’s your choice: You can start receiving monthly payouts at the qualifying age of 62 like many people. Or you can hold out for a bigger payout down the road.

It’s your call – and it could be a game-changer in retirement. Though an immediate need for funds will usually trump other considerations, delaying Social Security for just eight years – until age 70 – could mean up to 30% more from Uncle Sam every month.

Some key considerations will likely factor into your claiming strategy:

What’s age got to do with it?

If 60 is the new 40, then 80 is the new 60. Longer life spans are only part of the story, though. The rest of it plays out every day in 21st century lifestyle and retirement expectations, not to mention philanthropic intentions or plans to help out the family or grandchildren.

Along with modern realities, retirees’ multiple income sources and investments are changing traditional Social Security claiming patterns. It may make more sense to begin drawing funds from other income sources while delaying Social Security. Or you may even decide to put off retirement for a few years to make it possible.

What’s your claiming combo?

If you’re married or in a relationship, you’ll want to look at where you both stand in relation to retirement. We’re talking “still working” versus “already retired.” Depending on your personal circumstances, a number of scenarios could apply, including:

- Both spouses or partners wait until 70 to claim

- One spouse or partner claims early while the other waits

- A lower-earning spouse claims a spousal benefit at or after full retirement age while deferring his or her own retirement benefit (available only to anyone born on or before May 1, 1950, from full retirement age through age 70)

Your claiming strategy may be as unique as your financial circumstances and retirement outlook.

What’s your gender?

Longer life spans apply here, too. Women, on average, outlive men. Take gender into account in your claiming strategy. Look at your gene pool, retirement expectations, and whether or not you’ll receive dependent Social Security benefits should you lose your spouse.

Give yourself the gift of planning ahead, especially as you approach Social Security eligibility, to help you get more from this valuable retirement income source.

Next steps

- Decide on a Social Security claiming strategy that works for you.

- Write it down, revisit it occasionally, and tweak it whenever necessary.

Wells Fargo Advisors does not provide tax or legal advice. Please consult with your tax and/or legal advisors before taking any action that may have tax and/or legal consequences.

Investments in securities and insurance products are: NOT FDIC-INSURED/NOT BANK-GUARANTEED/MAY LOSE VALUE

Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC, Member SIPC, a registered broker-dealer and non-bank affiliate of Wells Fargo & Company. © 2017 Wells Fargo Clearing Services, LLC. All rights reserved.